Tax & Compliance

As tax planners we provide proactive strategies

Effectively reducing taxes requires extensive tax planning that considers all possible deductions and tax code changes.

We work closely with our clients to generate strategies that take advantage of today’s incentives and prepare for tomorrow’s tax challenges. Some accountants only connect with clients at tax time but we’ll stay in touch with you all year to proactively manage your tax burden and obtain ideal results at tax time.

As your tax advisor, we make ourselves available to answer your questions and help you make important financial decisions that could impact your taxes. We understand how to effectively manage both state and federal tax obligations and will continually adjust your plan so that it is in line with any new legislation. With our strategies, you’ll reduce your tax burden and will retain more of your income.

We provide planning for individuals, corporations, trusts and estates that are seeking effective strategies to keep more of what they’ve earned. We also prepare all types of tax returns, including individuals, businesses, gifts and estates, trusts, nonprofits and foundations.

As tax planners we provide proactive strategies to ensure that you reduce your tax liability and take advantage of all tax savings opportunities.

Have you considered the following?

- How to use tax-loss harvesting to offset your investment gains

- How to manage your tax bracket and make adjustments

- How to maximize your charitable deductions in a tax-efficient way

- When you should do a Roth conversion

- What to do with your stock compensations from a tax perspective

- What the most tax-efficient way is to withdraw money from your taxable and non-taxable retirement accounts

We partner with you to plan, educate and help manage your finances throughout the year.

- Proactive year-end tax planning ensures the advantage of all possible tax saving options and you avoid any last-minute surprises

- Education with regard to taxation – what deductions are available and how to document the data

- Year-round tax consulting. This ensures that we take advantage of all of the most current tax laws

- Annual management meetings to discuss tax impact of your decisions

- Client Web portal provides secure, password protected site that creates a single point of access to your sensitive documents

- Regular newsletters and blog posts covering the most current tax laws that can affect your bottom line

- Representation and guidance for you with inquiries from tax authorities

Tax Client Relationship

The relationships that we enjoy with our tax clients encompass several stages and considerations that most often lead to them becoming life-long clients of our firm.

In fact, many of our tax clients refer the subsequent generations of their family members to us.

Following is how we approach those individuals who may be interested in our tax planning and compliance services. For a detailed view of the relationship please click here.

Introduction & Discovery

This is an introduction that can easily be done in-person or virtually. Getting to know you and your situation, as well as providing you with a detailed understanding of our process is an important first step in determining if our services are a good fit for you.

Deep Dive

We collect all your financial information so that we can assess the current overall state of your financial health and identify potential issues. Our primary focus is on confirming that you are complying with tax laws. With careful consideration of tax law, we then ensure that you are planning according for the future so that you can maximize every possible benefit that is available to you. Data collection includes financial and legal documentation (previous tax return, estate planning documentation, legal documentation, financial planning documentation).

Recommendations & Ongoing Support

After a thorough analysis of your financial information, we prepare your return and carefully consider tax consequences for today and in the future. We provide you with recommendations to minimize your overall tax liability and put you in the best possible positions for future years.

Business Owner Considerations

- Data collection also includes QuickBooks or other software files and additional legal documentation regarding the business and organization documents.

- Tax strategizing

- Entity structure recommendation

- Consideration of various credits and deductions including Research & Development (R&D),

- Energy and Education credits, Paycheck Protection Program (PPP), Employee Retention Credit (ERC)

- Withholdings and estimates

- Cost segregation studies

- Review of accounting records and format of financial reports

- CFO and Bookkeeping services options

- Exit planning/Transition strategy that incorporates a personal financial plan and life after business plan

- Fraud Prevention and risk assessment

- Retirement plan assessment

- Transition planning should begin 3-5 years prior to planned transition

In many cases we work closely with *Copper Leaf Financial to implement our recommendations. Many tax decisions need to factor in your financial goals (and vice versa).

Business Tax Planning & Compliance

Tax planning done correctly for your business has a direct impact on your personal taxes.

Even if there’s an accounting error you can’t see, it still has the potential to become a sizable and costly problem to solve when it comes time to file your business tax return(s). We can help by examining your financial data and addressing any potential issues for your business now – instead of when we are preparing your return.

By ensuring proper planning, Davis & Hodgdon Advisory Group is able to identify potential tax credits or deductions as we always look for ways to decrease your tax liability and help you retain more of what you earn.

Tax Preparation services for all types of entities including:

- C Corporations

- Partnerships

- Limited Liability Corporations (LLC)

- Limited Liability Partnerships (LLP)

- S Corporations

Individual Tax Planning & Compliance

Throughout the year, there are actions that can be taken that will help reduce your tax obligation.

We believe that comprehensive and timely tax planning is the key to lower taxes for individuals and take a proactive approach to tax services. By always remaining current on new tax laws and legislation, we can identify essential tax planning opportunities that minimize both your current and future tax liabilities.

Services:

- Tax preparation

- Multi-state tax services

- Tax planning and advocacy

- Charitable giving planning

- Estate planning

- Divorce

Estates & Trusts

Whether you’re considering creating a comprehensive estate plan for the first time or conducting a review of an existing plan, our team has extensive expertise in evaluating estate planning and wealth transfer strategies.

With effective estate planning, you can achieve your long-term goals for transferring wealth.

Whether you have charitable interests or a variety of beneficiaries, minimizing tax liability on the transfer of assets is an important consideration in a well-designed estate plan. We will work closely with you and other professionals – including attorneys, charities and other advisors – to ensure that your estate plan accomplishes your goals.

Proper estate tax planning involves structuring the estate plan to maximize the tax benefits allowed by law.

There are various special trusts and entities under the tax laws that help accomplish the transition of substantial wealth and often work in conjunction with life insurance. This may involve a single – or several – techniques integrated together. No one technique will apply to all situations, therefore planning and analysis must take into account asset values, family dynamics, and class of assets involved (e.g., is there a family business?).

By planning ahead, you are able to control how your property and business is passed to your heirs. An estate plan can make it easier to protect your estate from heavy taxation, freeing up assets for immediate financial needs, and avoiding probate.

The degree of your estate planning depends on your age, financial situation, your life expectancy, and other non-financial reasons. Anyone with children or significant assets should begin developing an estate plan immediately. It’s not a question of if you need estate planning – it’s how much planning your estate needs.

We work with attorneys to ensure:

- Development, refinement of your Will

- Power of Attorney for finances

- Power of Attorney for health care

- Living Will

- Guardianship designation

- Completed beneficiary designation

- Elder law

- Nursing home and Medicaid planning

Davis & Hodgdon Advisory Group completes numerous trust tax returns every year. Each one is as unique as the person who created it. We meticulously review each trust document to determine how the trust will be treated from a tax standpoint. Most trusts continue for many years as a living legacy of the creator. Other trusts distribute their assets quickly and are closed down. Your trust document helps us understand how best to help complete your tax return. In most instances, the trust’s income is distributed to the beneficiaries. This creates a tax liability for the people who receive this income, which must be reported on that person’s personal tax return. When we prepare your trust return, we must be certain of the tax implications of all of the accounting income of the trust and how it is distributed.

Tax Authority Representation

Businesses operating in multiple states can be subject to a wide variety of state taxes.

About Nexus

The national Nexus program was created in 1990 by the U.S. Multi-state Tax Commission. Its main goal is to foster increased state tax compliance by businesses that are engaged in multi-jurisdictional commerce.

Nexus can be a complicated and easily misunderstood issue for a company with a multi-state presence. There are some activities conducted by a business that could involve Nexus for sales and use tax, income tax, franchise tax, or other business taxes. One way to understand and adhere to these greatly differing provisions is to have our tax professionals review the statutes of each state in which your organization might be considered as doing business.

Does Nexus apply to you?

Sometimes, Nexus obligations may not be blatantly obvious, especially for sales and use tax. As well, some states impose different types of taxes that might not be familiar to business owners and managers, such as those on gross receipts or business activity.

If you need assistance with any of the above Nexus issues or are unsure if it applies to you, we have the expertise in-house to help.

Nonprofit

We understand the intricacies of federal and state compliance requirements for nonprofit organizations.

As such, we can help your organization safeguard its most valuable asset – tax-exempt status. Davis & Hodgdon Advisory Group offers a complete spectrum of tax planning, compliance, and consulting services for nonprofit organizations.

We continually monitor pending legislative and regulatory changes and work with you to develop innovative tax strategies designed to comply with federal and state laws. This is critical to avoiding unnecessary penalties and sanctions, and helps to better manage your organization’s income tax liabilities.

Other nonprofit services include:

- Financial Statements: Audits/Reviews/Compilations

- Board Member Services

- Development of board member manuals, policy and procedure manuals, fraud prevention policies, board recruiting procedures and adherence to the agency-wide mission statements Budgeting and Management Consulting Services

- Internal Controls

- We make recommendations to improve your accounting systems and procedures Perform audits of nonprofits to determine where elaborate internal controls are impractical because of an organization’s size and can recommend controls to protect the organization’s assets and produce accurate reports

- Attendance at board meetings

- Fundraising

- Grant compliance

- Grant applications

* Copper Leaf Financial is an affiliated and separately registered entity.

Meet the CPA Team

Bret L. Hodgdon

Mandy Bradley

Matthew S. Cleare

Ryan Black-Deegan

Kathryn C. Diedrichsen

Dawn G. Grenn

Aida Volpone

Margery McCracken

Donna London

Jocelyn Geiger

Andrea Gafford

Gwen Pokalo Hart

Zach Davis

Ali Hassan

William Brown

Tyler Marks

Angela Barrows

Ashalin O’Connell

Laraib Asim

Kayla Adams

Griffin Smith

Alix Prouty

Liz Price

Eric Barker

Marissa Richardson

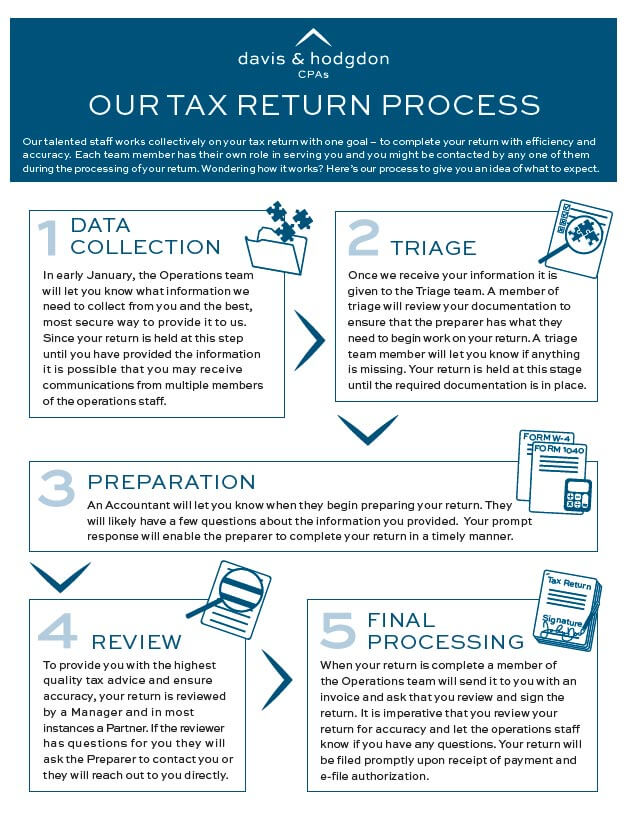

Our Tax Return Process

Our talented staff works collectively on your tax return with one goal – to complete your return with efficiency and accuracy.

In early January, the Operations team will let you know what information we need to collect from you and the best, most secure way to provide it to us. Since your return is held at this step until you have provided the information it is possible that you may receive communications from multiple members of the operations staff.

Once we receive your information it is given to the Triage team. A member of triage will review your documentation to ensure that the preparer has what they need to begin work on your return. A triage team member will let you know if anything is missing. Your return is held at this stage until the required documentation is in place.

An Accountant will let you know when they begin preparing your return. They will likely have a few questions about the information you provided. Your prompt response will enable the preparer to complete your return in a timely manner.

To provide you with the highest quality tax advice and ensure accuracy, your return is reviewed by a Manager and in most instances a Partner. If the reviewer has questions for you they will ask the Preparer to contact you or they will reach out to you directly.

When your return is complete a member of the Operations team will send it to you with an invoice and ask that you review and sign the return. It is imperative that you review your return for accuracy and let the operations staff know if you have any questions. Your return will be filed promptly upon receipt of payment and e-file authorization.

Resources

We offer an extensive library of resources for our clients and friends

Select the options on the right to view each type of resource.

Related Services

Do something wise today

Schedule a time for a free consultation.