Tax Planning and Tax Preparation are NOT the Same Service

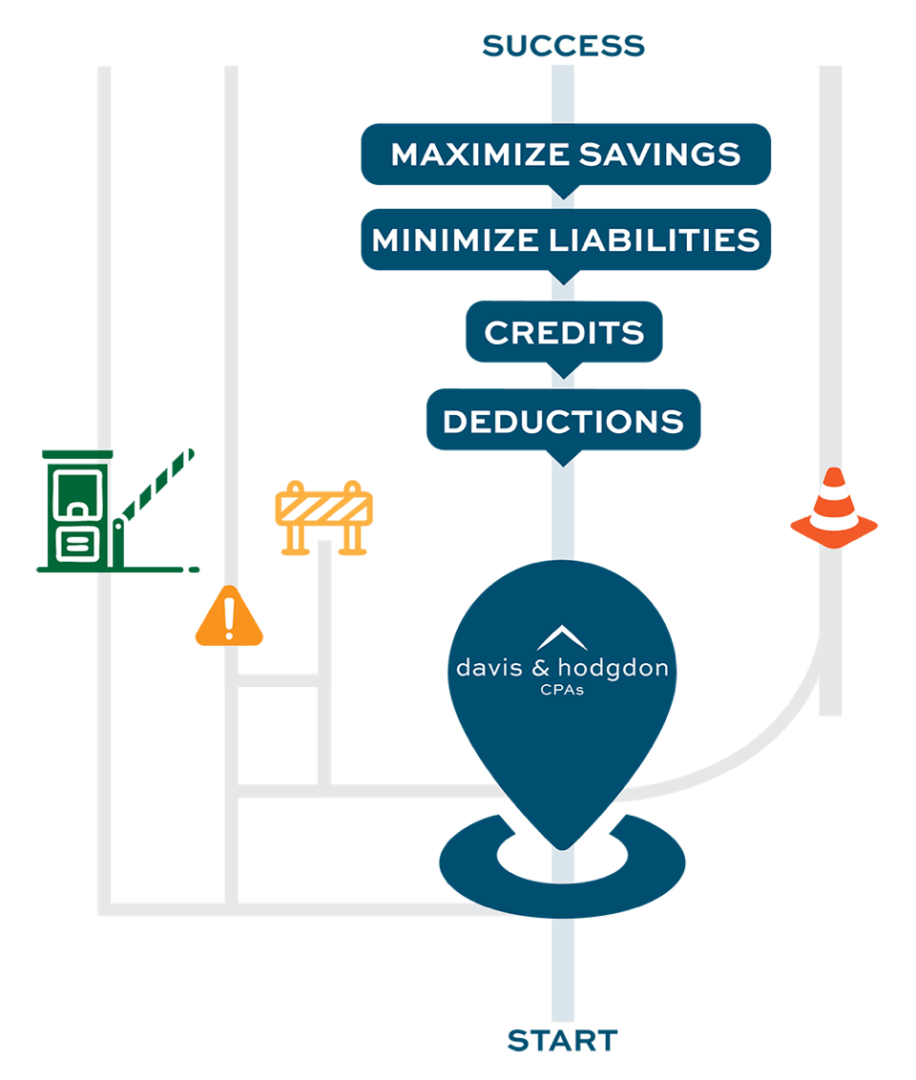

Think of tax planning as the GPS guiding your financial plan.

In the same way that a GPS helps you navigate the most efficient route, avoid roadblocks, and safely reach your destination, tax planning ensures you take advantage of deductions, credits, and strategies to minimize liabilities and maximize savings. With careful tax planning you can avoid unnecessary detours, costly penalties, or missed opportunities, and stay on course toward wealth accumulation and long-term financial success.

As tax planners Davis & Hodgdon provide proactive strategies to ensure that you reduce your tax liability and take advantage of all tax savings opportunities.

Have you considered the following?

- How to use tax-loss harvesting to offset your investment gains

- How to manage your tax bracket and make adjustments

- How to maximize your charitable deductions in a tax-efficient way

- When you should do a Roth conversion

- What to do with your stock compensations from a tax perspective

- What the most tax-efficient way is to withdraw money from your taxable and non-taxable retirement accounts

In light of the Tax Cuts and Jobs Act (TCJA), there are many other considerations to add to your tax planning list. Most significant for business owners, is the impact of the Qualified Business Income Deduction (QBID) and the opportunity to make adjustments to your strategy so that you can capitalize on this tax break! Click here to learn more.

Also noteworthy for businesses is consideration of the Research & Development Tax Credit which our clients have saved millions on since 2016. Click here to learn more.

Davis & Hodgdon CPAs works closely with clients to generate strategies that take advantage of today’s incentives and prepare for tomorrow’s tax challenges. Reach out to us today to schedule a tax planning strategy session.

Do something wise today

Schedule a time for a free consultation.

Resources: https://www.investopedia.com/advisor-network/articles/difference-between-tax-preparation-and-tax-planning/#ixzz5TRGv2Rzy