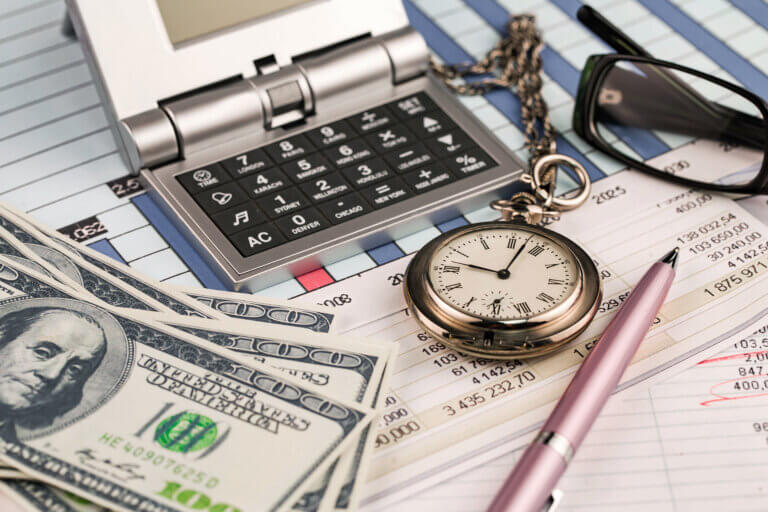

Most Retirees Need to Take Required Retirement Plan Distributions by Dec. 31

According to the IRS, taxpayers born before July 1, 1944, generally must receive payments from their individual retirement arrangements (IRAs) and workplace retirement plans by Dec. 31.

Known as required minimum distributions (RMDs), these payments normally must be made by the end of 2014. But a special rule allows first-year recipients of these payments, those who reached age 70½ during 2014, to wait until as late as April 1, 2015 to receive their first RMDs. This means that those born after June 30, 1943 and before July 1, 1944 are eligible for this special rule. Though payments made to these taxpayers in early 2015 can be counted toward their 2014 RMD, they are still taxable in 2015.

The required distribution rules apply to owners of traditional IRAs but not Roth IRAs while the original owner is alive. They also apply to participants in various workplace retirement plans, including 401(k), 403(b) and 457(b) plans.

For the full article visit: http://www.irs.gov/uac/Newsroom/Most-Retirees-Need-to-Take-Required-Retirement-Plan-Distributions-by-Dec.-31

Davis and Hodgdon Associates CPAs has been assiting nonprofits, individuals and businesses with tax and accounting services in the Burlington Vermont Metro area for more than 20 years. If you have any questions or concerns please feel free to call 802.878.1963 or email [email protected].