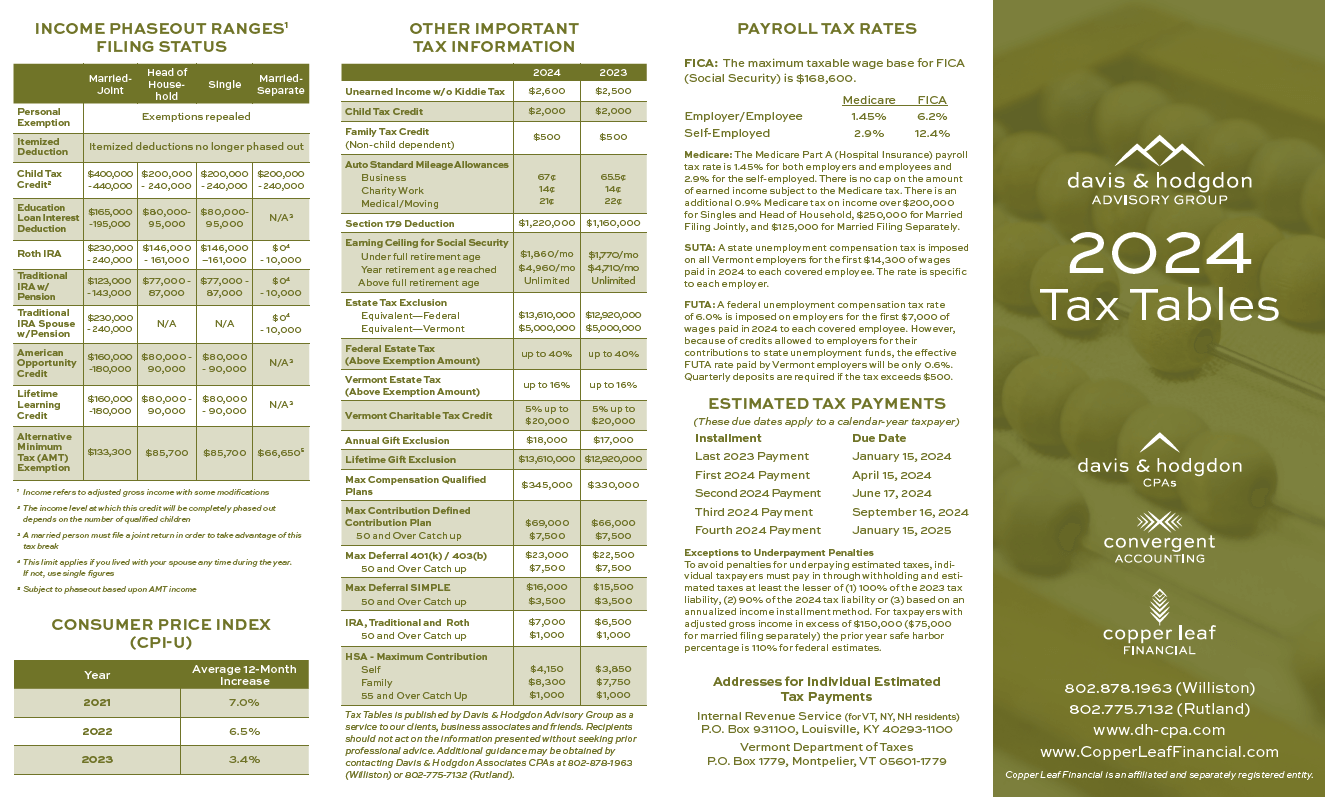

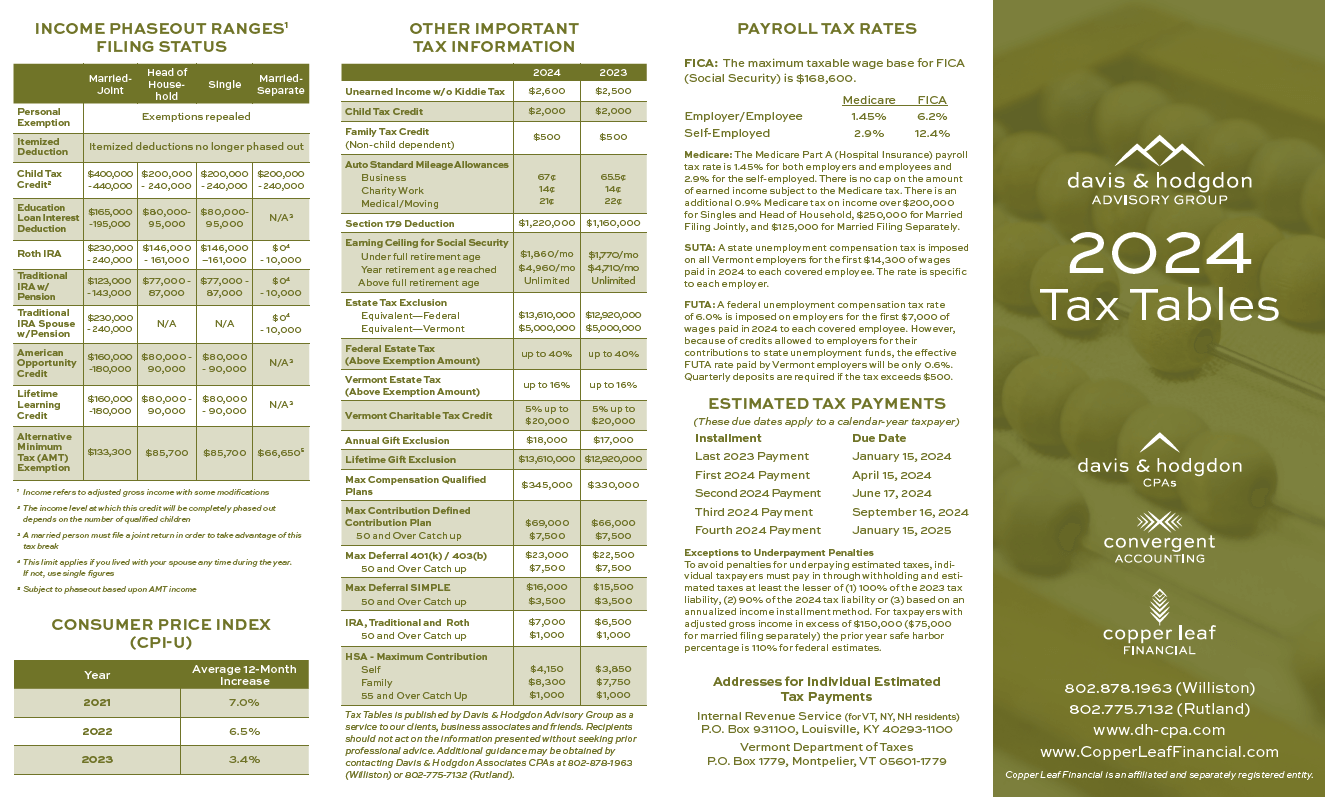

2024 Tax Tables Brochure

Davis & Hodgdon’s annual tax tables brochure for 2024 is ready for download! All important tax information is included here so please click here to view!

Davis & Hodgdon’s annual tax tables brochure for 2024 is ready for download! All important tax information is included here so please click here to view!

Rising interest rates have become a key tool for central…

Our new issue of Nonprofit Notes is now published on…

The 2025 tax season is underway, and if you’re like…