Key Person Bonus Plan

Choosing and adopting the best manner to compensate key people in your company will help encourage them to stay with your company and become real partners in your company’s success.

Two Ways to Compensate

There are two ways you can compensate people. The first is to pay your employees to do what seems to be a “good” job. When you pay for a seemingly “good” job, you compensate your people on an hourly basis or with a regular salary and they get the job done.

The second way you can pay people is for performance. Here, they become accountable for the economic outcome of your business. Paying for performance means a significant portion of compensation is based on either the individual’s performance or the performance of the company or a combination of the two. The difference between the two ways to compensate equates to the difference between your employees doing a “good” job versus going above and beyond and doing an “excellent” job!

Arlene has two managers in her company who are very important to her success.

Both of them could either positively or negatively impact profits based on the decisions they make. If the company has a good year she will pay them some extra money; if the company has a bad year, she still feels she should give them something for their effort.

Arlene communicates how the company is doing with these key people, but she doesn’t have personal responsibility of company profit levels assigned to them.

Initial Steps

Arlene needs to commit to having a program in place where her managers are compensated in a major way for the performance achieved by the company. She should implement the following steps:

- Develop corporate goals for all relevant areas. Include financial and non- financial metrics/measurements.

- Have the bonus payments represent at least fifteen percent of the total compen- sation of her managers.

- Assign the managers profit centers for which they are responsible. If possible, develop a profit and loss statement for these profit centers.

- Consider paying part of the bonus in cash now and part of the bonus to be paid out in the future.

Additionally, key people in your company often receive bonus payments of some sort. Unfortunately, these bonus payments are rarely tied to specific performance measures for the manager or the company. As an example:

The first step in setting up bonus plans is to understand what your goals are for corporate returns. The prime measurements are Gross Profit Margin and Net Profit Margin. From there, Arlene should develop performance metrics for each department based on areas that each manager has control over. Once goals are established, Arlene should then relate those metrics to profit requirements for the company.

The next step is to concentrate on having managers understand and accept that a minimum of up to 10-20% of their compensation will be based on how well their division and or the company does. It may prove beneficial to com- bine personal performance measures with corporate performance measurements.

Arlene could work towards paying her man- agers 90% of expected pay with salaries. Having her managers have the ability to earn an additional 10-20% through a bonus plan allows them to achieve higher than average compensation. While Arlene cannot lower her managers’ base salary to accommodate the bonus, she can explain her goals and use the bonus structure to give raises going forward while increasing the incentive to perform.

Personal responsibility should exist in management compensation plans. Establishing economic measures within the responsibilities of managers is important in moving in this direction. Only part of a bonus plan should be based on personal accomplishments. A portion should also be based on corporate performance. Managers should think globally about their bonus. Having a bonus that is only based on individual performance measurements can cause managers to work only for their bonus.

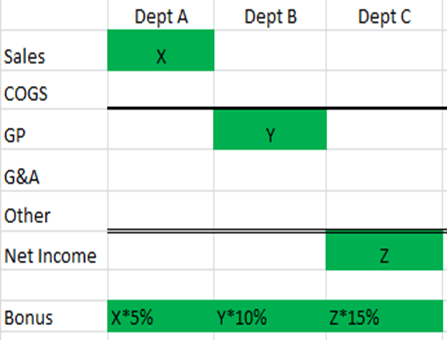

Below is an illustration of bonuses based on corporate performance. Each employee will be judged based on areas that are under their control. Therefore one employee may be judged based solely on “X” sales, while a second employee may have control over the cost of goods for their department so will be judged on Gross Profit “Y” while a third may be responsible for all related expenses and be judged on the Net Income “Z” of a department or the company as a whole.

Cash and Deferred Payment?

The final step Arlene needs to consider is whether or not to have part of the bonus paid in cash and part paid as deferred money. We often invest a large amount of effort and money in making sure our managers have skills and training to do their jobs properly. We want to make sure they stay with us for as long as possible. Having part of their bonus plan deferred is an incentive that will help keep your managers with your company.

You might consider having as much as 50% of the bonus deferred and 50% in present cash. Often clients use either a rolling five-year or three-year vesting schedule for the deferred portion of the bonus. A rolling vesting schedule means that what is earned this year is deferred for five years, while what’s earned the year after would have a new five- year vesting schedule. Eventually your managers will have five years of bonus money vesting at all times.

In order to make certain you do not overlook key people, write down the critical functions in your business that affect operations and profitability. Every business is different and will in most cases have different key functions so there is no one list that will give you all the key functions in your business. You can define key people as broadly as you want. Some common examples of key person identifiers are listed below:

- Responsible for sales

- Responsible for other employees

- Responsible for procurement

- Responsible for a department

- Responsible for product mix

- Responsible for strategic planning

Adopting these suggestions can help your company compensate key people in a more logical manner, help encour age them to stay with your company and invest them as real partners in your company’s success.

Davis & Hodgdon business advisory services include assistance in creating a structured bonus program—one that will invest all players into your company’s success. Establishing bonus plans is just one in a unique brand of services focused squarely on the needs of growing businesses. For more information contact us today or visit our Convergent Accounting web page.