Business Client Accounting

Convergent Accounting helps you take control of your finances so you can focus on your business.

Convergent Accounting

We enjoy crunching numbers but chances are good that as a small business owner, you may not. In fact, you probably started your business because you had a great product or service to offer and not because you were excited about cash flow analysis, profit and loss statements, budget forecasting and strategic tax planning.

That’s why we’re here – and we can help you operate advantageously.

Are you too busy to focus on growing your business? Our proactive, targeted approach for Convergent Accounting clients, like you, is designed to save them time and money while catalyzing growth and helping them reach their financial goals.

Let us handle your bookkeeping and eliminate your busy work. We provide:

- Confidential, cost-effective bookkeeping support for a fixed monthly fee

- On-demand, real-time access to your financial data 24/7

- Freedom from hiring and training costly full-time bookkeeping staff

- The opportunity to free up time for your existing staff

- Accurate reliable records with real-time operating results to help you run your business more efficiently which can also translate to efficient tax planning and savings

- A solution to the problem of maintaining privacy of information amongst your staff

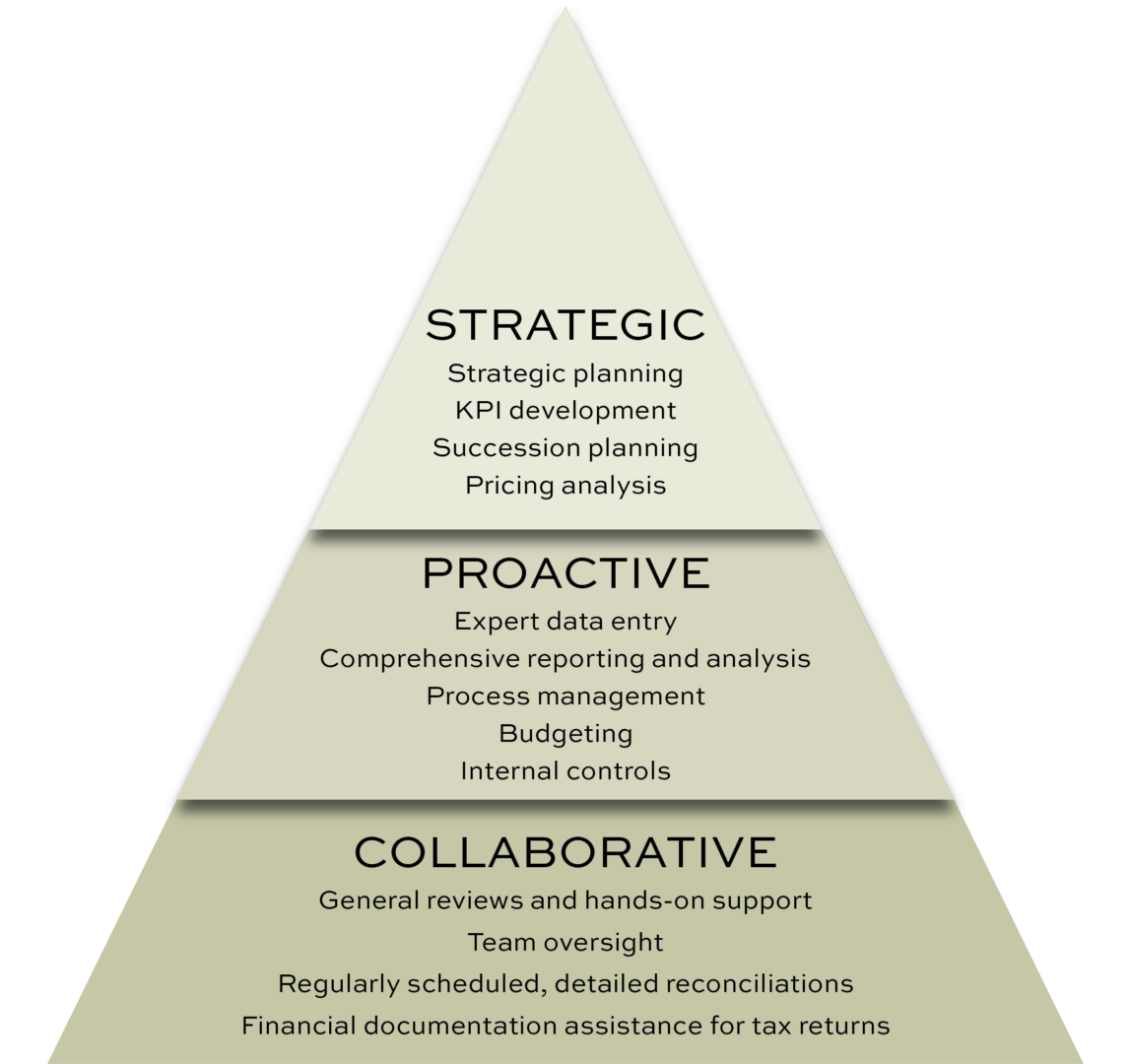

Tiers of Service

Includes a full-service remote accounting department with tactical financial leadership services. Develop, grow, and run your business with confidence.

Our most popular tier for small- to medium-sized business clients provides you with a comprehensive remote accounting department. Stay up to date with weekly status reports and monthly financial documentation. You receive a team of professionals to take the day-to-day tasks off your plate!

Access to an expert accountant who will provide a second set of eyes on your bookkeeping. Receive monthly professional analysis to ensure timely, accurate data recording. Monthly, rather than annual recordkeeping and analysis provides you with the tools to better manage your business. It can also result in better tax planning and potentially more tax savings.

Convergent Accounting Services

While you focus on your business, take advantage of Convergent Accounting:

- Processing bills quickly and easily. Streamline your bill paying process.

- Providing 3rd party payroll support. Posting of payroll journal entries and quarterly payroll reconciliation will provide accurate reporting of payroll transactions for business planning and year-end tax reporting.

- Maintaining and reconciling your financial accounts. Through your company’s accounting file you can securely view your balances in real-time for all of your business bank, credit card and loan accounts, with each account being fully reconciled by the 15th of every month.

- Customizing detailed KPI statements and Pulse reports so you can see how your business is doing in five minutes or less. Your data is collected in real time so we can offer you a current, accurate view of your financial status throughout the year.

So much of what we do at Convergent Accounting involves not only helping our clients with their bookkeeping but acting as a valuable and reliable resource. The list of articles below is one of the wealth of tools we have to enable our clients to be educated about the topics and issues affecting how they operated their businesses.

While navigating the pandemic we realized we needed better financial guidance.

After interviewing 5 accountants, Matt Cleare of Davis & Hodgdon was the hands down winner. D&H is an excellent partner for us, mitigating our company’s tax risks and providing expert guidance which allows us to focus on managing and growing our floral business

Tom and Kim Jennings

Owner, Green Mountain Floral Supply

Meet the Convergent Team

Matthew S. Cleare

Kathryn C. Diedrichsen

Genevieve Smyth

Sarah Lyons

Melanie Caracciolo

Emma Longe

Jay Smith

Kayla Adams

Zach Davis

Marissa Richardson

Rebecca Rimondi

Resources & Articles

We offer an extensive library of resources for our clients and friends.

Select options on the right to view resources specific to manufacturers.

Articles:

- Business Owners: Use QuickBooks Online to Create and Manage Your Budget

- Which QuickBooks Online is Right for Your Business?

- What You Need to Know About 1099 Compliance

- Now is the Time to Post Year-End Journal Entries

- Embracing Remote Bookkeeping During the Global Pandemic

- Why Having Up-to-Date Bookkeeping Records is Crucial to the Success of Your Business

- QuickBooks Online: Two Ways to Archive Files You No Longer Need

- Are You Accurately Recording Credit Card Transactions in QuickBooks?

- The Importance of Reconciling Your Bank and Credit Card Accounts

- How Are Your Payroll Transactions Being Entered into QuickBooks?

- Business Owners: Tools to Help Simplify your Bookkeeping Tasks

- Create Efficiencies with Bank and Credit Card Feeds in QuickBooks Online

- Cloud-based Solutions Might Be the Next Best Step for Your Growing Business

- Save Time Entering Historical Data With AutoEntry

- Advantages of Using the QuickBooks Accounting App

- Business Owners: It’s Time for You to Simplify Your Bill Paying Process

- Keep All of Your Financial Records in One Place With HubDoc

- Tracking Your Business Expense Receipts Just Got Easier

- Chart of Accounts- Critical For Bookkeeping Success

- The March 15 Deadline for Business Tax Returns is Approaching: Avoid These Common Accounting Errors

Related Services

Do something wise today

Schedule a time for a free consultation.